What is Claim Denial ?

A claim denial is defined as a statement from an insurance payer declining to pay for an approved healthcare service/procedure. The reasons that a payer provides for denying payment on a claim often include:

-

Submission of incomplete claim documentation

-

Missing information on submitted claims

-

Failure to adhere to payer regulations and processes

-

Payer-specific claim policies

The management of denied claims is an organized approach to identifying and analyzing denied claims, appealing, and ultimately preventing denied claims within the larger context of RCM.

Who are the Claim Denial Stakeholders ?

Multiple stakeholders throughout the healthcare ecosystem are impacted by denial of services:

-

Providers and healthcare systems lose timely reimbursement for services provided

-

Revenue Cycle Management (RCM) Teams face increased administrative constraints

-

Payers and health plans incur more operational expenses due to claims that are inaccurate or non-compliant

-

Patients may experience delays in obtaining coverage or may receive incomplete benefits as a result of denied insurance claims

Claim denials impact all types of healthcare delivery systems and financial operations from a small ambulatory clinic to a multi-facility regional hospital.

When Do Claimed Denials Occur ?

Claim denials can occur at numerous stage(s) of the claim lifecycle:

-

Pre-Submission - where the claim documentation and patient's demographic and eligibility details are incomplete

-

During Processing - when the claim does not meet insurer rules, authorization requirements or medical necessity standard(s)

-

Post-Submission - when mistakes are made in the adjudication of the claim, duplicate claims are submitted, or audit irregularities occur in payer adjudication

The use of real time denial prevention tools allows providers to be more efficient in preventing denials prior to the submission process, as opposed to having to resolve them afterwards.

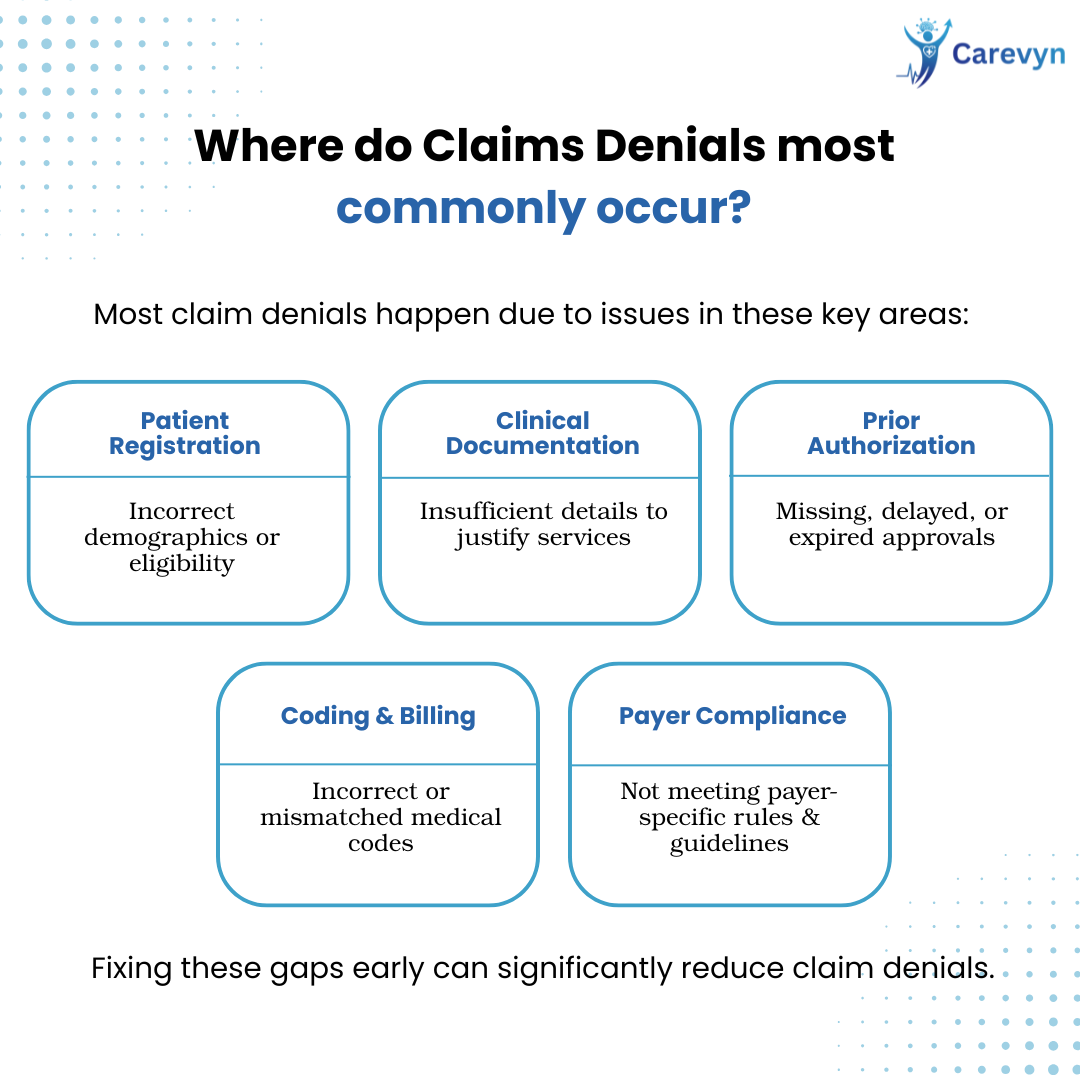

Where do Claims Denials most commonly occur ?

Claim Denials typically occur in the following locations:

-

Patient Admission Registration (Incorrect Demographics or Lack of Eligibility)

-

Clinical Document Creation/Submission (Insufficient Detail to Justify Services)

-

Authorization Workflow Issues - Authorization workflows are the basis for authorization denial / rejection. If the payer does not receive all required prior authorization documentation, or delay / expired status of prior authorization documentation affects claim approval / adjudication.

-

Coding and Billing Issues - Incorrect medical codes result in incorrect billing (adjudication) of medical claims by an insurance payor.

-

Payer Rules Compliance - Insurance payers have specific rules and guidelines pertaining to prior authorization. When the provider does not meet the payer's requirements, the claim is denied.

In addition to these commonly cited reasons for denied claims, many others exist. Denial points for both providers and payers exist internally within provider organizations and in the rules and adjudication systems of payers and health plans. To effectively manage denials, a provider must have visibility into this entire spectrum.

Key Reasons for Claim Denials

1. Incorrect / Incomplete Patient Demographics

Many claims are denied because of errors in patient demographic data, such as typos in patient name, incorrect date of birth, incorrect policy number, etc. Checking for errors at the point of entry and verifying using real-time eligibility check significantly reduces the likelihood of error due to incorrect data.

2. Lack of Prior Authorisation

The vast majority of procedures, tests and/or treatments require authorization from the payer. If an authorization is not obtained and documented, the claim will be denied—even if the care provided was medically necessary.

3. Coding Errors

Errors related to the clinical level coding (i.e., ICD-10 or CPT) are one of the leading causes for service denials. The sheer number and complexity of coding rules create challenges for both providers and payers. Reducing or eliminating coding errors at the clinical level via the use of automated AI driven coding tools significantly reduces this cause of claim denials.

4. Problems With Insurance Eligibility

Claims submitted for patients with inactive, expired, or otherwise non-eligible coverage will likely be declined. Denial for previously unfiled claims in the future will not happen once a claim is verified through real-time eligibility. Claims will be processed according to the payer's billing time frames.

5. Duplicate Claims

The payer will routinely deny duplicate claims submitted in confusion due to workflow discrepancies, system interruptions, and other operational mistakes. The establishment of a structured claims process with a tracking system will assist in alleviating this issue for all payers.

6. Timely Claims Submission

Timelines for submitting claims set by payers are very tight and if not adhered to, you will automatically be denied—even if it's only by a few days! The automation of your processes will provide an easier, simpler way to submit claims on time.

7. Inadequate Documentation

Claims submitted when the documentation submitted does not demonstrate medical necessity or meet requirements set by the payer are also routinely denied. Having a comprehensive set of guidelines and standardized processes for documenting and coding can enhance clarity and reduce the risk of claim denials.

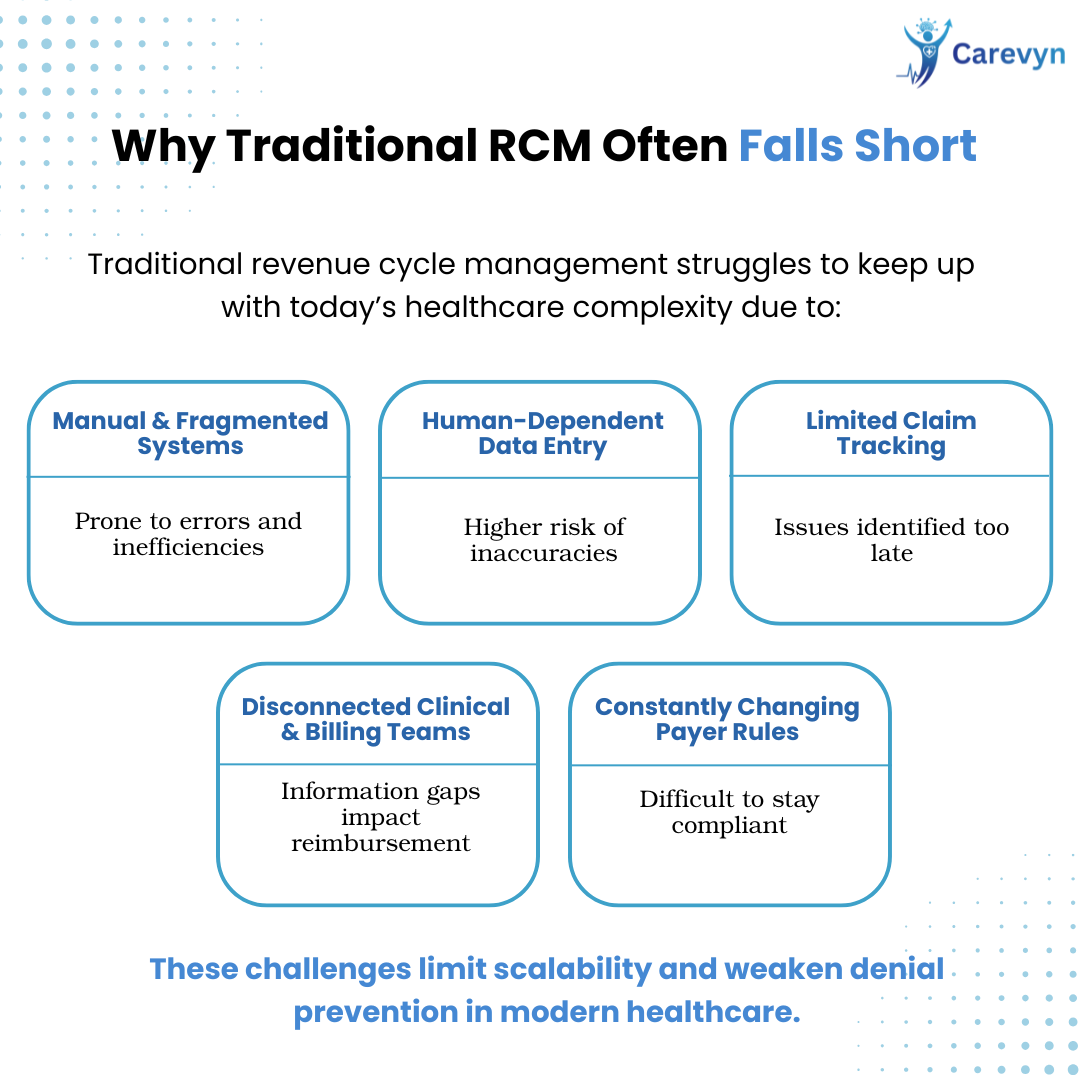

Why Traditional RCM Practices Often Fall Short

Healthcare organizations' traditional revenue cycle management practices have fallen short because of their reliance on fragmented and even manual denial management systems that were not built for today's fast-paced, complex environment. The traditional revenue cycle management approaches rely heavily on human accuracy in the data entry process, resulting in a higher likelihood for errors to be made. Because there are so many different types of claims and so few ways to track them in a truly timely manner, billing and coding issues are often overlooked until it is too late. Another area where the traditional RCM approaches fall short is that the clinical and billing operations typically do not have seamless systems and processes to share information, which creates significant gaps between the clinical and billing operations. Finally, the fact that the rules and guidelines related to insurance payers are constantly changing creates an additional barrier to healthcare organizations staying informed regarding the most current and most relevant payer information. Collectively, these barriers significantly limit a healthcare organization's ability to scale its denial prevention and resolution processes within a modern healthcare setting.

A Better Approach to Claim Denials

Successful management of claim denials is ongoing. You will want to develop an action plan, with the following elements:

1. Check Eligibility Early and Often

Verifying coverage and benefits when you receive a patient will prevent a claim from being submitted with an ineligible patient.

2. Automate Prior Authorizations

Automation makes obtaining necessary prior authorizations and tracking easier, reducing the chances for manual errors and delays.

3. Improve Documentation and Coding

Invest in Automated systems that will assist you in ensuring that you submit only compliant clinical notes and up-to-date coding in order to prevent a claim from being submitted with inaccurate information.

4. Use Predictive Analytics

Using predictive analytical tools you can predict / view / understand / see patterns within the historic claims that will identify high-risk claims before submission. (Source: Carevyn)

5. Standardize Workflow Processes

Standard Operating Procedures (SOPs) create uniformity among employees by creating a standard method for creating, submitting & following-up on claims; ensuring that all claims are submitted within the same time frames (no variation due to human error).

6. Monitor and Analyze Deny Reasons

Root Cause Analysis (RCA) allows the teams to identify systemic problems in the organization so they can develop corrective action plans on a large scale. (Source: Carevyn)

7. Utilize Intelligent Appeal Management

In cases where denials are inevitable an effective and automated system to support the appeals process (correct documentation and insight) allows for faster resolution and improved cash flow.

Carevyn's Structured, AI-driven Approach to Denial Prevention and Revenue Cycle Management (RCM)

Carevyn provides healthcare organizations with a structured approach to denial prevention, as well as an AI-driven platform for enhancing revenue cycle management (RCM). Proper usage of the Carevyn platform allows organizations to use real-time predictive analytics to determine denial risk factors, and therefore alert RCM teams to potential denials prior to submitting claims for payment, allowing for early corrective action to be taken. Carevyn provides a platform for the straightforward and timely recovery of denied claims via the implementation of an automated workflow to resolve denied claims, which alerts when a claim is declined and automatically routes the claim back to the provider, along with documented evidence and processes for correcting and resubmitting denials efficiently.

Carevyn also provides significant insight into the root cause of denied claims, as it identifies trends in denials and the underlying reasons, enabling revenue leaders to proactively address ongoing issues in addition to simply reacting to specific claims. Additionally, Carevyn ensures that coding and documentation accuracy is at least 98% or better, which reduces the frequency of errors or incomplete claims that lead to claim denials. Due to these enhanced capabilities, several organizations that utilize Carevyn experience a decrease in claim denials of 30%, as well as a measurable improvement in revenue capture, revenue cycle management (RCM), operational workflows, and provider satisfaction.

The issue of denied insurance claims is a multifactorial problem that can significantly impact both the financial health and the operational efficiency of all healthcare organizations. Denied claims typically originate from patient information issues, unapproved authorizations, mistakes made during coding, and lapses in patient eligibility; however, the majority of these problems can be avoided through the use of a proactive, automated, data-driven strategy for managing denied claims.

Healthcare providers and payers who utilize a platform such as Carevyn can expect to reduce the number of denied claims they receive while also increasing their RCM capabilities and spending more time focused on patient care and less time managing administrative responsibilities.

Frequently Asked Questions (FAQs)

1. What does a claim denial mean?

When a payer (i.e., insurance company) denies your claim for health care service or supplies because of a mistake(s) in form submission, missing information, or noncompliance with their established guidelines.

2. Why is denial management critical to Revenue Cycle Management (RCM)?

Proper denial management will prevent revenue lost to denial; lessen the amount of time and effort required for administrative activities; and improve cash flow, thus strengthening the financial position of health care providers.

3. What is the percentage of claim denials that can be reduced through the use of an automated solution?

Evidence indicates that the use of automation and Artificial Intelligence (AI) in managing denials can reduce denials by between 30% and 50% based on patient outcome data.

4. What differentiates denial prevention from denial resolution?

Prevention involves stopping the problem prior to submitting the claim, while resolution occurs after the claim has been submitted and includes taking action to receive payment.

5. Can denial management benefit patients?

Yes, Denial management can lead to quicker and more accurate claims processing to limit the volume of patient billing disputes and administrative delays in accessing care.